T-accounts are used to track debits and credits made to an account. On the flip side, when you pay a bill, your cash account is credited because the balance has been reduced since you recently paid a bill. They work with the double-entry accounting system to reduce the chance of errors.

- A summary showing the T-accounts for Printing Plus is presented in Figure 3.10.

- T-accounts can be a useful resource for bookkeeping and accounting novices, helping them understand debits, credits, and double-entry accounting principles.

- When filling in a journal, there are some rules you need to follow to improve journal entry organization.

- Then, these journal entries are transferred into the general ledger, in the form of T accounts.

- Understanding the difference between credit and debit is essential for this process.

- I will use my coffee shop to represent a business throughout these examples.

Everything to Run Your Business

A T-account is used to track specific transactions, while the balance sheet is a summary of a company’s overall financial position. Both statements are important tools in accounting and finance, and they are used to help stakeholders understand a company’s financial health. Whether you are an accountant https://www.steelplate.net/how-to-add-music-to-a-facebook-post/ or a decision-maker the language of business finance is rooted in accounting. Whatever your role is in the business, it’s worth grasping the basics of this language. Every transaction a company makes, whether it’s selling coffee, taking out a loan or purchasing an asset, has a debit and credit.

Normal Account Balances

The left side of the Account is always the debit side and the right side is always the credit side, no matter what the account is. Others sought out the cameras to offer eyewitness accounts, but they were jumbled and sometimes contradictory amid the panic. AT&T also says customers should only open text messages from people you know and trust, and shouldn’t reply to a text from an unknown sender with personal details.

Are T-Accounts relevant in digital accounting?

T-accounts are typically used by bookkeepers and accountants when trying to determine the proper journal entries to make. When you’re ready to use T-accounts, you can use them separately, in order to view journal entry details, or you can enter the transaction directly into your journal. Whether you use T accounts, a general ledger, or both to record every transaction, that’s only the start of monitoring and forecasting your financials. These are essential elements of the continued success of any business. Double-entry accounting is a method of recording every transaction twice to ensure that nothing is missed. Every transaction has two equal parts, a debit one and a credit one.

- For the revenue accounts, debit entries decrease the account, while a credit record increases the account.

- We know from the accounting equation that assets increase on the debit side and decrease on the credit side.

- In this section, I’m going to go through different types of transactions, and I’ll be using T-accounts to display the movement of value through the business.

- T-accounts help to visualise the process making it clear what is occurring with each transaction.

- That makes T accounts a good place to start when thinking about bookkeeping and accounting, but also financial management.

T Account Examples

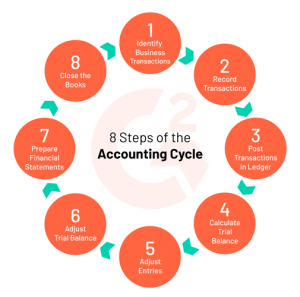

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Now these ledgers can be used to create an unadjusted trial balance in the next step of the accounting cycle. The standard T-account structure starts with the heading including the account name. The left column is always the debit column while the right column is always the credit column. A business owner can also use T-accounts to extract information, such as the nature of a transaction that occurred on a particular day or the balance and movements of each account.

- Understanding who buys gift cards, why, and when can be important in business planning.

- So grasping these basics helps you delve into these reports and understand the financial story they tell.

- My inventory is reduced each time I sell a coffee so I need to credit the inventory account by 50p, reducing its value.

- A single transaction will have impacts across all reports due to the way debits and credits work.

- Still not convinced Deskera is the right choice for your business?

- A single entry system of accounting does not provide enough information to be represented by the visual structure a T account offers.

T-Account Debits and Credits

When you’re running your own business, you probably don’t have a ton of spare time to journalize transactions and write down T accounts into the ledger by hand. After assessing what debit and credit entry applies to each specific account, T accounts can be created. To create and record a T account, you have to know how debit and credit rules apply to the different types of accounts. T Accounts are also used for income statement accounts as well, which include revenues, expenses, gains, and losses. The call and text message records of nearly all of AT&T’s cellular customers were exposed in a data breach, the company said Friday. You can see that a journal has columns labeled debit and credit.

Even with the disadvantages listed above, a double entry system of accounting is necessary for most businesses. This is because the types of financial documents both businesses and governments require cannot be created http://home-business-start-up.com/HomeBasedBusiness/home-based-business-opportunities-australia without the details that a double entry system provides. These documents will allow for financial comparisons to previous years, help a company to better manage its expenses, and allow it to strategize for the future.

With that being said, the five most common types of accounts in financial accounting are assets, liabilities, expenses, revenue, and owner’s equity. Each T account carries the debit and credit entries for a different type of account, such as accounts receivable, cash, sales revenue, and so on. A T account resembles the letter T and visually represents the debit and credit entries of financial transactions. For instance, a company hires some extra temporary labor for a busy period in their factory. The accounting department later catalogs those labor payments under “operating expenses” instead of under “inventory costs” (which is where factory labor costs should go).

This ensures a complete record of financial events is tracked and can be accurately represented by financial reports. Debits are always posted on the left side of the t account http://start.crimea.ua/haval-jolion-mozhno-priobresti-v-kredit-s-minimalnyimi-vyiplatami-ot-1943-grn-mesyats while credits are always posted on the right side. This means that accounts with debit balances like assets will always increase when another debit is added to the account.