In conclusion, the management of liabilities is crucial for maintaining financial stability and favorable cash flows. As liabilities impact both the balance sheet and cash flow statement, businesses must carefully consider their decisions regarding debt, tax management, and other obligations. A company may take on more debt to finance expenditures such as new equipment, facility expansions, or acquisitions. When a business borrows money, the obligations to repay the principal amount, as well as any interest accrued, are recorded on the balance sheet as liabilities. These may be short-term or long-term, depending on the terms of the loan or bond.

Cash Flow Considerations

No, money market accounts have variable interest rates that can move up or down over time. Consider another banking product, like CDs, if you’d like a fixed interest rate. Vio Bank, Connexus and Ally Bank currently offer among the highest money market rates on accounts with no or a low minimum balance requirement. First Internet Bank and Connexus also offer some of the best MMA rates if you can meet the higher minimum balance required to earn the full APY. We also considered whether there were complex tier structures or requirements to earn the APY or other stipulations to earn the APY. High minimum deposit and balance requirements affected scores negatively.

Who must pay estimated tax

Less liquidity is required to pay for long-term liabilities as these obligations are due over a longer timeframe. Investors and analysts generally expect them to be settled with assets derived from future earnings or financing transactions. As you continue to grow and expand your business, you’re likely going to take on more debt as you go. This is https://www.highfashion.ru/life/travels/untouched-nature-tanzania why it’s critical to understand the differences between current and long-term liabilities. Plus, making sure that they get recorded properly on your balance sheet is just as important. A contingent liability is a potential liability that will only be confirmed as a liability when an uncertain event has been resolved at some point in the future.

Who does not have to pay estimated tax

Look into EverBank’s Yield Pledge MMA if you want to take advantage of a generous promotional APY and prefer to have debit card and ATM access. Money market account transfers out of the account to repay loans at Sallie Mae are unlimited. You’re limited to 10 convenient withdrawals and transfers per month with this account. While Ally no longer charges excessive transaction fees, it can close your account if you continually exceed this limit. Ally reimburses for up to $10 per statement cycle for fees charged by out-of-network U.S.

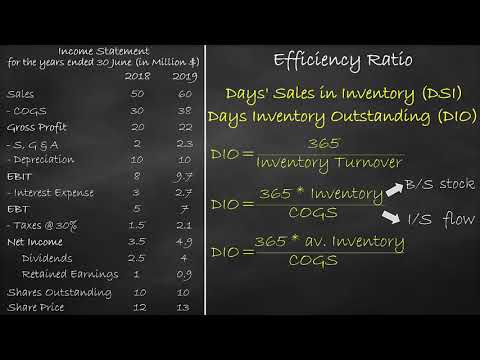

These debts typically become due within one year and are paid from company revenues. Assets and liabilities are two fundamental components of a company’s financial statements. Assets represent resources a company owns or controls with the expectation of deriving future economic benefits. Liabilities, on the other hand, represent obligations a company has to other parties.

- Except for fees and penalties, there is no way to lose insured deposits in an MMA.

- But not all liabilities are expenses—liabilities like bank loans and mortgages can finance asset purchases, which are not business expenses.

- No, money market accounts have variable interest rates that can move up or down over time.

- On the flip side, you’ll have to wait a few days any time you want to access the cash in your Vio Bank MMA, which could present a challenge if an emergency comes up.

- Using the balance sheet data can help you make better decisions and increase profits.

- Less liquidity is required to pay for long-term liabilities as these obligations are due over a longer timeframe.

- Overall, liabilities will almost always require future payments depending on the agreement between you and the other party involved.

- Unearned Revenue – Unearned revenue is slightly different from other liabilities because it doesn’t involve direct borrowing.

- The applications vary slightly from program to program, but all ask for some personal background information.

- Certified public accountants Jack Sardis, 66, and George Sanossian, 70, also agreed to pay $652,883.60 in restitution to state and federal authorities.

- Assets include things such as inventory, equipment, supplies, intellectual property, and land.

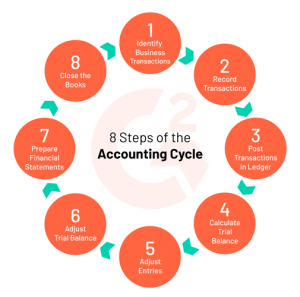

If there is a long-term note or bond payable, that portion of it due for payment within the next year is classified as a current liability. Most types of liabilities are classified as current liabilities, including accounts payable, http://www.columb.net.ua/news/4262/ accrued liabilities, and wages payable. In accounting, liabilities are debts your business owes to other people and businesses. Examples of liabilities include bank loans, IOUs, promissory notes, salaries of employees, and taxes.

The debt to capital ratio

EverBank charges $10 per transaction over the allowable limit of six per statement cycle. EverBank recognizes five balance tiers—less than $10,000, between $10,000 and $24,999.99, between https://sgn0016.com/maintaining-business-continuity-through-cybersecurity/ $25,000 and $49,999.99, between $50,000 and $99,999.99 and $100,000 and up. To get a debit card or checks, you’ll need to open a separate checking account with First Internet Bank.

- Rather, it invoices the restaurant for the purchase to streamline the drop-off and make paying easier for the restaurant.

- With the app, Bethpage members can send money to friends and family through its Pay Anyone feature, deposit checks, transfer money, pay bills and take advantage of free budgeting and savings tools.

- Assets are a representation of things that are owned by a company and produce revenue.

- After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program.

- Liabilities are reported on the company’s balance sheet and are also one of the three components of the basic accounting equation.